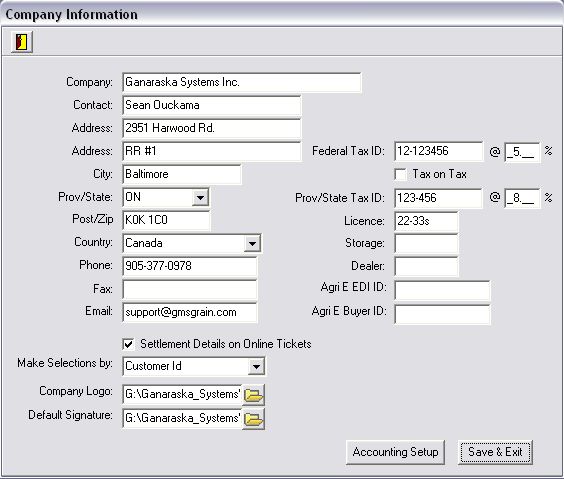

Company Information

- GMS2000 comes with the State/Province code table pre-loaded with both Canadian and United States codes.

The above example shows Ontario as a province and Canada as a Country. The COUNTRY MUST be selected first then the State/Province. - The Tax rates are required if any tax is applied to the Grain Tickets.

- If checked the calculation for taxation is compounded

- Fed tax (GST) = taxable item X 5%

- State/Prov Tax = (taxable item + Fed Tax) X 8%

- to change which items are taxable you must go to the Tax tables

- If checked the calculation for taxation is compounded

- Agri E EDI and Buyer ID are only visible with the Eleview Module, these numbers are provided by them

- Settlement Details – when you printout an OnLine ticket do you want the ticket stub to show Pricing details or just weights

- Make Selections By – Utilize customer short forms or use there entire name when entering data

- Company Logo – a copy of your company logo to be included on reports (Not Required)

- Default Signature – A Copy of a signature to place on digital copies of your contracts (NOT Required)

- Accounting Setup – Configure your Accounting Link

Now that the Company Info is complete you should go directly to the Grain Tables following will need to be set up to suit your business. If you do not have all the available modules installed you may not need to complete all tables, i.e. if you do not have AR, AP, or GL you will not need to complete the GL accounts Table: